How We Actually Teach Investing

Most people learn about money through trial and error. We think there's a better way. Our approach combines practical experience with structured guidance, so you build real understanding instead of just memorizing formulas.

We've been refining these methods since 2018, working with individuals who had everything from zero financial knowledge to years of scattered investment experience.

What We Believe About Learning

Understanding Beats Memorization

You don't need to memorize every financial term. But you do need to understand how different investment types actually work. We focus on the why behind financial concepts, not just the what.

Start With Real Scenarios

Every lesson begins with actual situations you might face. Should you pay off debt or start investing? How do you evaluate if a stock is overpriced? We tackle these questions with real numbers and honest answers.

Build Gradually

Our September 2025 program starts with basic concepts before moving into more complex strategies. You won't find yourself lost because we rushed through fundamentals. Each module builds on what came before.

Our Teaching Process

Six practical steps that transform financial confusion into confident decision-making.

Assess Current Knowledge

We start by figuring out what you already know. Some participants understand bonds but not stocks. Others have the opposite background. This shapes how we present new material.

Introduce Core Concepts

Each session introduces one major idea through a real-world example. Then we break down how it works, explore common misconceptions, and discuss when it applies to your situation.

Practice With Numbers

You'll work through calculations using actual market data from Belgian and European markets. No theoretical examples with perfect numbers that never happen in reality.

Discuss Common Mistakes

We spend significant time on what goes wrong. Understanding why certain strategies fail helps you avoid repeating those errors with your own investments.

Connect to Your Goals

Every concept ties back to practical applications. Whether you're planning retirement or building an emergency fund, we show how each strategy fits different financial objectives.

Review and Adjust

Regular check-ins ensure you're grasping the material. If something isn't clicking, we adjust our approach. Learning speed varies, and that's completely normal.

Core Values in Our Teaching

These principles guide every lesson we create and every conversation we have with participants.

Honesty About Limitations

No investment strategy works perfectly all the time. We discuss both the strengths and weaknesses of different approaches. You'll learn when certain strategies make sense and when they don't.

For instance, we explain why dividend investing can be attractive for some goals but might not be ideal if you're in a high tax bracket.

Respect for Your Time

Our modules are designed to be completed in focused sessions. We don't pad content with unnecessary information. Each lesson contains what you actually need to know, explained clearly.

Typical sessions run 90 minutes with one core concept thoroughly explored rather than five topics briefly mentioned.

Practical Over Theoretical

While we cover the theory behind investment principles, the focus stays on application. How do you actually evaluate a mutual fund? What questions should you ask your bank? These practical skills matter most.

Ongoing Support

Questions don't stop when the session ends. Participants can reach out when they encounter real situations where they need clarification. This continued dialogue helps cement understanding.

Meet Your Instructor

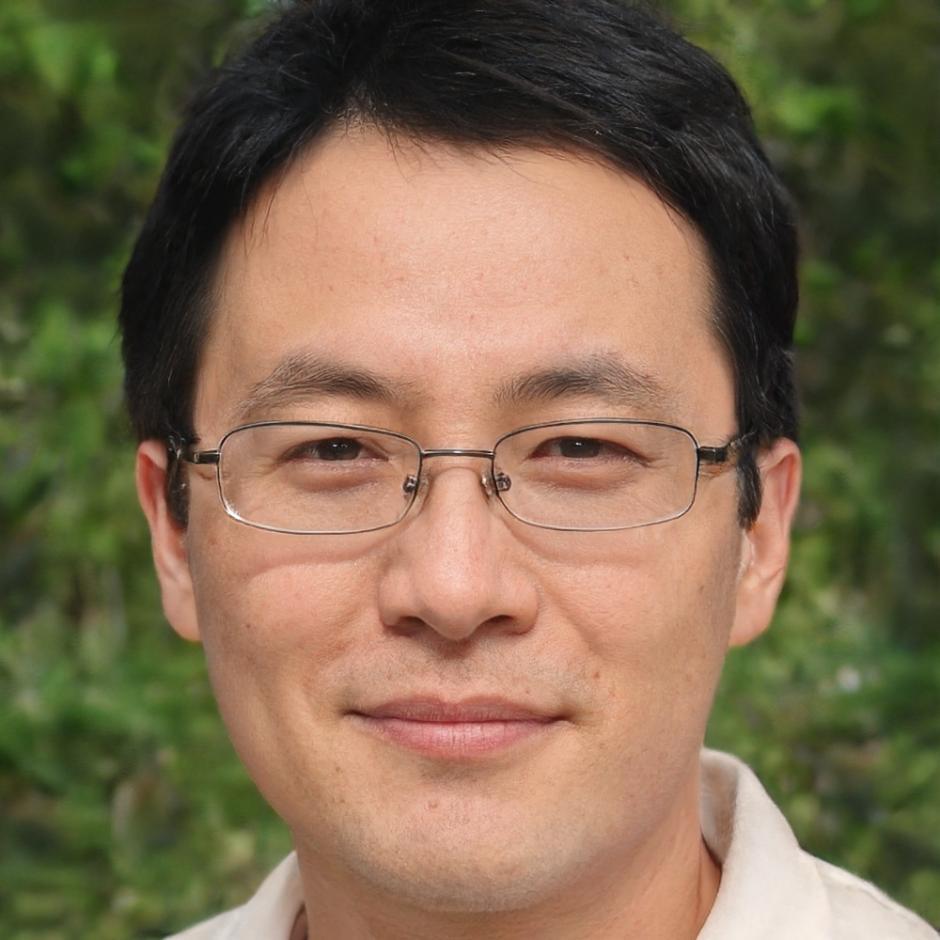

Pieter Lauweryns, Investment Education Specialist

I started teaching investment fundamentals after spending twelve years working in financial analysis. The transition happened because I kept meeting people who felt overwhelmed by conflicting advice and complicated jargon.

My background includes portfolio management for mid-sized European firms and personal experience building my own investment strategy from scratch. I know what it's like to make mistakes with real money, which makes me a better teacher.

What I enjoy most is watching concepts click for someone. That moment when dividend yields suddenly make sense, or when a participant realizes they can actually evaluate their current investments. That's why I do this work.

Ready to Start Learning?

Our next introduction to investing program begins in September 2025. Spaces are limited to maintain the quality of interaction and personalized guidance we're known for.